September 21, 2019|Arizona Phoenix homes, Arizona Real Estate, Buy House, Cash offer for houses, Chandler Realtor, Invell Homes, Investing, Sell House

Why Real Estate is an ‘IDEAL’ investment compared to Stocks

September 21, 2019|Arizona Phoenix homes, Arizona Real Estate, Buy House, Cash offer for houses, Chandler Realtor, Invell Homes, Investing, Sell House

They are both great investments, but at certain times and market conditions, you may

decide to use either of these tools. You may want to use both of them simultaneously.

Having financial education and knowing how to use every investment tool to your

advantage is key.

While any kind of investment would involve a certain amount of risk, investment in both

real estate and the stock market is comparatively safer if the investor does his part of

due diligence. Although some may find themselves exceptionally lucky investing in

stocks, it is generally seen that investment in real estate is a more lucrative and safer

bet to make. Due to its tangible nature, you can drive by your property and be rest

assured that whatever you invested has come back to you in the form of brick and

mortar structure and is not floating somewhere in the virtual world of stocks, which is

controlled by so many external factors.

A shareholder of a company has no control over his investment. You never know what

happens behind closed doors. Just try to remember the corporate disasters that

happened in the last decade. With real estate, you have full control over the happenings

of your business. For example, if the bills are too high at your property, you can identify

the problem and take on measures to reduce costs and improve your investment. With

stocks, there is not much you can do if your shares drop in value. You can buy more, or

you can sell more.

We think real estate is the best investment you could make. As Robert Kiyosaki says,

“Real estate investing has created more millionaires than any other form of investing

because of its many advantages. Whether you’re investing for cash flow or capital

gains, your success is dependent on your education.” There are many more reasons

why real estate is great and there are a total of 5 “IDEAL” reasons we would like to

share.

I ncome , D epreciation , E quity , A ppreciation , L everage

1) Income – Cashflow

Investing in real estate offers cash flow. Let’s review the income benefits of real estate.

Income maybe the most important piece, especially to a buy and hold investor

(Landlord). If you buy right, this will lead you to positive cash flow, financial freedom,

and early retirement.

If you have invested in real estate, then you can make money through several different

avenues, with the most common being rent. While it is possible that you can earn

income from the installation of a cell tower or Billboards, the vast majority of income

from residential property comes in the form of rent. Tenants pay a fixed amount each

month – and that will increase with inflation and demand. After deducting expenses and

depreciation, your income is nearly tax-free.

The best way to determine your cashflow is to understand how to calculate it.

Gross Rent – Expenses = NOI (Net Operating Income) this is your net cashflow if there

is no loan in place. If there is a mortgage in place you would deduct your loan payment

also known as Debt Service (DS) from the NOI and this will give you your cashflow

earnings.

2) Depreciation – “It’s not how much you can make but how much can you keep”

The IRS allows depreciation deductions. These tax deductions can’t all be taken at

once, so that’s where depreciation comes in. This depreciation can be claimed as a

loss on your taxes although you really didn’t lose anything. For residential rental

property, the building may be depreciated over 27.5 years. For commercial property, it

is depreciated over 39 years.

So you may be wondering how does this work? For example, let’s say the cost of the

property is $150,000. The IRS will consider about 20% of the purchase price as land

value which would give the building a value of $120,000. Now, Take $120,000 and

divide by 27.5 years this will give you $4,363 a year in depreciation or LOSS. Think

about it; you really didn’t lose anything. Let’s say your rental property generated $2,500

in profit or NOI. Your $4,363 deduction would make your $2,500 profit tax-free income.

After you deduct your profit from your deduction, you would still have $1,863 of losses

to apply towards other income you have generated.

When financing a property, the interest paid on the mortgage is also a deductible

expense for an owner. Few of the more common interests that homeowners can deduct

from their overall income include interest paid on loans used to acquire or improve the

property, interest on credit cards used for the payment of goods and services used in

the rental property. The cost of the repair (if repairs are necessary and reasonable in

amount) can be deducted from the income of the year in which they happened. Good

examples of deductible repairs include repairing gutters or floors, repainting, plastering,

fixing leaks, and replacing broken windows.

Please do not use this advice without speaking to a professional CPA. As you know,

taxes are very complicated. Talk with your CPA and have a discussion on Depreciation

for your rental property, and how it applies to your specific situation.

3) Equity – Build it up

Equity can be built when using financing to purchase an investment property. Most

mortgages are amortized to reduce the loan balance over time. Every time your tenant

pays you rent, you apply it towards your mortgage. As your mortgage balance

decreases every month, you are building up your equity.

Another benefit of your equity increase is how you can pull some equity back out of your

property in the form of a home equity loan. This extra cash might make sense if you

would like to purchase more investment properties. This should never be used to buy

vacations, cars, and as Robert Kiyosaki would say doodads! Also use caution before

borrowing more money. Plan to have some savings for vacancies, repairs etc. Consider

your new interest rate and make sure your property will still provide cashflow.

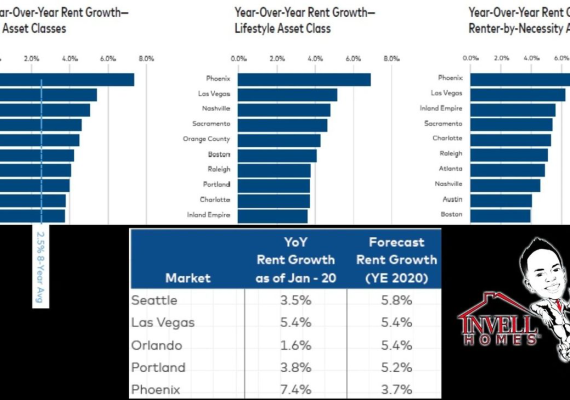

4) Appreciation – Icing on the Cake

One of the most significant ways of making money in real estate is through

appreciation. Therefore, its understanding is crucial. Appreciation is the stock market

function of the real estate investing business. When you invest, Appreciation is the icing

on the cake. Since we’ve discussed three other benefits of real estate investing, you

know by now that we could still build wealth even if we ignored appreciation. However,

we don’t recommend purchasing an investment solely on appreciation. When the

property is likely to show an appreciation, people prefer to buy in that area rather than

rent.

Why properties appreciate?

The reason why the land appreciates is simple. It is available in limited quantities, and it

cannot be manufactured. Demand for land is growing steadily as the population grows,

and since its supply is limited, the price should increase with time. Unless something

happens to restrict the demand or render the land of a particular area unusable, you can

expect the value of it to increase over time. An average annual pace of 3.7 percent

appreciation for the next five years was predicted. Of course, this varies by state, city,

and even neighborhood, so be sure to do research in your town.

Why is it easy to benefit from appreciation in real estate?

It is often possible to buy a property below the market rate. Some real estate

professionals manage to get houses 40-60% below market value. They buy houses

from people that want to sell quickly due to major repairs or distress in one’s life. Yes,

one can buy undervalued stocks but that is not the same as buying below the market

rate. Market value is the money for which your house can be sold today. Undervalued

stock is the stock that the market has not assessed properly, and which is likely to grow

in the future.

5) Leverage – How regular people lift boulders

Leverage: The use of various financial instruments or borrowed capital, to increase the

potential return of an investment.

Leverage makes it possible for real estate investors to accelerate financial growth and

make more money, making real estate investments more lucrative than stocks. If you

want to buy a stock, you must pay the full value of the shares at the time of ordering.

Even if you buy on margin, the amount you can borrow is still much lower than the real

estate sector.

Most mortgages require anywhere from 0% – 20% down payment (varies depending on

loan type and lender) of the total value of the asset. This means that you can control all

assets and the capital held by paying a fraction of the total. Real estate is one of the few

investments where you can have 100% control of an investment with only 20% or less

equity ownership! Sure, with lending you are indebted to the bank but you won’t see the

bank coming by to tell you how to manage your real estate investment!

Unlike stocks, real estate is an asset you can control …that’s why we love it. The ability

to control your investment is what makes real estate so appealing. So, put this IDEAL

Investing tip to work. There is never a better time than the present to start investing. If

you don’t start now, you may never end up doing so.

We don’t need to be convinced about the benefits of real estate, but how about you?

If you have any questions or would like to start investing on Real Estate. Send me a

message and I will be more then happy to help you or to answer any questions.